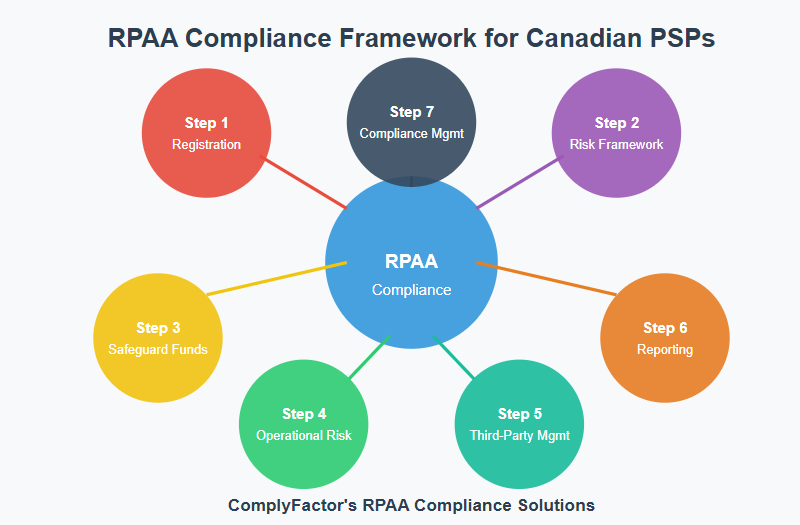

The Retail Payment Activities Act (RPAA) represents a landmark shift in how Payment Service Providers (PSPs) are regulated in Canada. For the first time, the Bank of Canada will directly supervise non-bank PSPs, creating new compliance requirements affecting thousands of businesses across the financial technology landscape. With full implementation expected by 2025, PSPs face a rapidly approaching deadline to align their operations with these new regulatory standards. This article outlines the seven critical steps Canadian PSPs must take to achieve RPAA compliance, providing practical guidance for navigating registration, risk management, data protection, reporting obligations, and more. By following this roadmap, PSPs can not only meet regulatory requirements but also strengthen their business foundations, build consumer trust, and position themselves advantageously in an increasingly regulated marketplace.

Introduction: Understanding the Retail Payment Activities Act

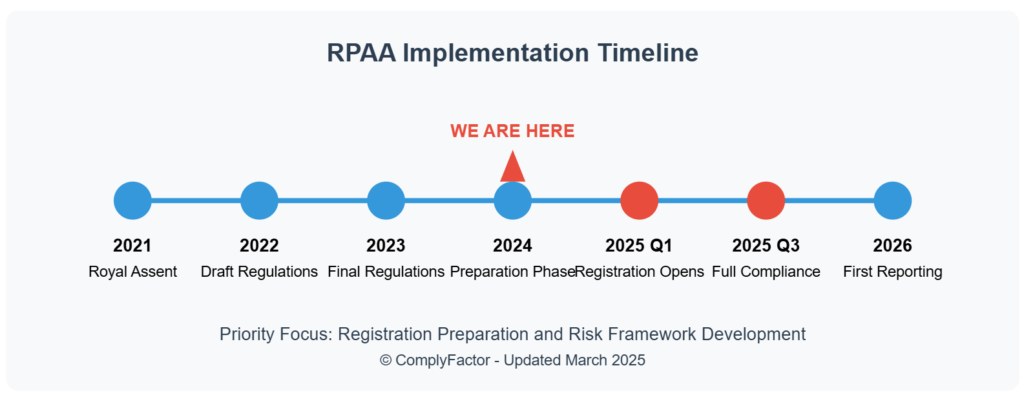

The Retail Payment Activities Act (RPAA), which received Royal Assent in June 2021, establishes Canada’s first comprehensive oversight framework for retail payment activities. This legislation fills a significant regulatory gap by extending supervision to previously unregulated non-bank PSPs—companies that help consumers and businesses initiate electronic fund transfers, process payment transactions, and provide electronic wallets.

Why the RPAA Matters

The RPAA emerges against a backdrop of rapid innovation in payment technologies. As consumers increasingly shift away from cash toward digital payment methods, the payments ecosystem has expanded to include a diverse array of service providers beyond traditional banks. Recent statistics from Payments Canada show that electronic payments accounted for 86% of total transaction volume in Canada in 2023, with this percentage continuing to climb.

The legislation serves three core purposes:

- Ensuring operational resilience of retail payment systems

- Protecting user funds against loss and unauthorized access

- Fostering innovation while building trust in payment services

For PSPs, compliance is not optional—the Act includes provisions for significant penalties for non-compliance, including administrative monetary penalties of up to $10 million for serious violations.

Scope of Application

The RPAA applies to any entity performing “retail payment activities” for end users in Canada. This includes:

- Payment processors

- Digital wallet providers

- Money transfer services

- Payment gateways

- Currency exchange services

- Point-of-sale payment providers

- Mobile payment applications

However, certain entities are excluded from the scope, including:

- Banks and other federally regulated financial institutions

- Provincial credit unions

- Systems designated under the Payment Clearing and Settlement Act

- Entities facilitating closed-loop payment systems (e.g., gift cards)

- Internal payment systems within corporate groups

With this context established, let’s turn to the seven essential steps PSPs must take to achieve compliance with the RPAA under Bank of Canada supervision.

Step 1: Determine Your Registration Requirements

The Requirement

The cornerstone of RPAA compliance is registration with the Bank of Canada. Any entity performing retail payment activities for Canadian end users must register unless they qualify for a specific exemption.

Implementation Guidance

Assessment Phase

- Conduct a thorough analysis of your business activities to determine if they constitute “retail payment activities” under the RPAA

- Document payment flows, highlighting where your organization stores, holds, or transfers funds on behalf of end users

- Evaluate whether any exemptions might apply to your operations

Registration Process

- Prepare required documentation, including:

- Corporate information (incorporation documents, organizational structure)

- Description of payment activities and business model

- Financial statements

- Information about significant owners and directors

- Submit your registration through the Bank of Canada’s dedicated RPAA portal

- Pay the applicable registration fee (expected to follow a tiered structure based on payment volume)

Common Challenges and Solutions

Challenge: Determining Application to Complex Business Models

Many fintechs operate hybrid business models that may partially fall under RPAA scope. For instance, a marketplace platform that processes payments between buyers and sellers while also offering separate services may struggle with determining registration requirements.

Solution: Map all payment flows carefully and consider seeking a regulatory opinion from the Bank of Canada or legal counsel specializing in payments regulation. The Bank of Canada has established a dedicated email address for preliminary scope inquiries.

Challenge: Cross-Border Considerations

PSPs operating internationally face questions about whether services offered to Canadian customers from abroad require registration.

Solution: The Bank of Canada has indicated that the “end user” focus means that any entity offering payment services to Canadian residents falls under the RPAA, regardless of where the PSP is headquartered. International PSPs should plan for Canadian registration if serving Canadian customers.

Timeline Considerations

Registration requirements will be phased in, with the Bank of Canada beginning to accept registrations in early 2025. PSPs should:

- Begin assessment immediately

- Prepare registration documentation by Q4 2024

- Submit applications when the Bank of Canada portal opens

- Allow 3-4 months for the registration review process

Step 2: Implement Risk Management Framework

The Requirement

The RPAA requires PSPs to establish, implement, and maintain a risk management and incident response framework specifically designed to identify and mitigate operational risks and respond to security incidents.

Implementation Guidance

Framework Development

- Create a comprehensive risk assessment methodology that identifies:

- Technological risks (system failures, data breaches)

- Operational risks (process failures, human error)

- Third-party risks (vendor dependencies)

- Fraud risks (unauthorized transactions)

- Business continuity risks (service disruptions)

- Establish clear risk tolerance thresholds aligned with your business model and scale

- Develop mitigation strategies for each identified risk, including:

- Preventive controls

- Detective controls

- Corrective measures

Incident Response Planning

- Create detailed procedures for:

- Incident detection and classification

- Escalation paths and decision authority

- Containment strategies

- Communication protocols (internal and external)

- Remediation and recovery processes

- Establish criteria for reporting significant incidents to the Bank of Canada (more on reporting in Step 6)

Common Challenges and Solutions

Challenge: Determining Appropriate Risk Framework Complexity

Smaller PSPs may struggle to develop frameworks that are robust enough for compliance without creating unsustainable administrative burdens.

Solution: The Bank of Canada is expected to apply proportional oversight, meaning requirements will scale with the size and complexity of the PSP. Focus on risks most relevant to your business model, and document your risk prioritization rationale.

Challenge: Testing and Validation

Proving the effectiveness of risk controls can be difficult, especially for newly established frameworks.

Solution: Implement a regular testing schedule including:

- Simulated incident scenarios

- Tabletop exercises

- Penetration testing

- Independent third-party assessments

Keep comprehensive documentation of all testing activities and results.

Timeline Considerations

PSPs should:

- Begin risk framework development immediately after registration

- Complete initial framework within 6 months of registration

- Implement full controls within 12 months

- Review and update the framework annually

Step 3: Safeguard End-User Funds

The Requirement

PSPs that hold end-user funds must implement specific safeguarding measures to protect these funds in case of PSP insolvency or financial difficulties.

Implementation Guidance

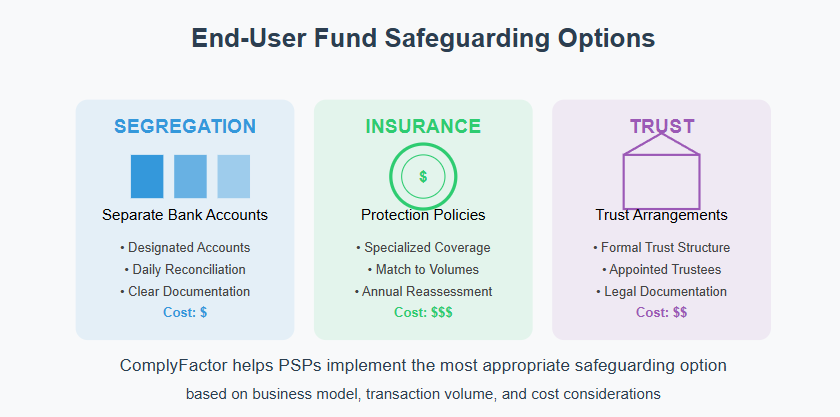

Safeguarding Options The Bank of Canada permits several approaches to fund protection:

- Segregation of Funds

- Establish separate accounts at regulated financial institutions

- Ensure accounts are clearly designated as holding user funds

- Implement reconciliation processes to verify segregation

- Insurance or Guarantee

- Secure insurance policies specifically covering user fund protection

- Obtain guarantees from financially sound institutions

- Ensure coverage levels match or exceed average holding amounts

- Trust Arrangements

- Establish formal trust structures with user funds as trust property

- Appoint appropriate trustees with fiduciary responsibilities

- Document trust arrangements compliant with provincial trust laws

Documentation Requirements Maintain detailed records demonstrating:

- Selection rationale for your safeguarding approach

- Legal opinions supporting the effectiveness of arrangements

- Regular reconciliation between user balances and protected amounts

- Policies preventing commingling of funds

Common Challenges and Solutions

Challenge: Cost of Safeguarding

Insurance premiums, trust administration, and dedicated accounts add operational costs that may strain smaller PSPs.

Solution: Consider a hybrid approach tailored to your business model. For instance, a PSP might use segregated accounts for routine holdings while securing insurance only for peak volume periods.

Challenge: Float Management

PSPs that experience significant fluctuations in fund holding amounts may struggle with dynamic safeguarding requirements.

Solution: Implement automated monitoring systems that alert when holdings approach insurance or guarantee limits, and maintain buffer capacity for unexpected volume increases.

Timeline Considerations

- Complete safeguarding arrangements within 6 months of registration

- Conduct first independent audit of safeguarding measures within 12 months

- Review arrangements quarterly to ensure adequacy relative to business changes

Step 4: Develop Operational Risk Controls

The Requirement

The RPAA requires PSPs to implement specific operational controls addressing cybersecurity, data protection, system reliability, and business continuity.

Implementation Guidance

Cybersecurity Framework

- Implement a defense-in-depth strategy including:

- Network segmentation and access controls

- Encryption for data in transit and at rest

- Multi-factor authentication for sensitive functions

- Regular vulnerability scanning and penetration testing

- Security information and event monitoring (SIEM)

- Develop secure development practices for payment applications:

- Code review processes

- Security testing methodologies

- Vulnerability management procedures

System Reliability

- Establish performance monitoring covering:

- Transaction processing times

- System availability metrics

- Capacity utilization trending

- Error rate monitoring

- Implement change management protocols:

- Impact assessment procedures

- Testing requirements

- Rollback capabilities

- Deployment windows minimizing user impact

Business Continuity

- Develop recovery time objectives (RTOs) and recovery point objectives (RPOs)

- Establish backup and restoration procedures

- Create alternate processing capabilities for critical functions

- Document communication protocols during outages

Common Challenges and Solutions

Challenge: Technology Integration Complexity

Many PSPs rely on multiple technology providers and platforms, creating integration points that complicate security and reliability controls.

Solution: Map all integration points and implement API security gateways that standardize security controls across connections. Develop integration-specific monitoring to quickly identify issues at system boundaries.

Challenge: Legacy Systems

PSPs that have grown through acquisition or evolved over time may struggle with older systems that lack modern security capabilities.

Solution: Implement compensating controls where legacy systems cannot be immediately upgraded, create a prioritized modernization roadmap, and document risk acceptance decisions with clear timelines for resolution.

Timeline Considerations

- Complete initial security assessment within 3 months of registration

- Implement critical controls within 6 months

- Achieve full framework implementation within 18 months

- Conduct annual independent security assessments

Step 5: Establish Third-Party Management

The Requirement

PSPs must maintain oversight of service providers and agents acting on their behalf, ensuring these third parties meet RPAA standards.

Implementation Guidance

Third-Party Inventory

- Document all service providers involved in payment processing, including:

- Technology providers

- Data center operators

- Payment networks

- Outsourced services (customer support, fraud monitoring)

- Agents and representatives

- Classify providers based on:

- Criticality to payment operations

- Access to sensitive data

- Concentration risk

- Substitutability

Contractual Controls

- Review and amend contracts to include:

- RPAA compliance requirements

- Right to audit provisions

- Incident notification obligations

- Performance standards

- Data protection requirements

- Business continuity capabilities

Ongoing Monitoring

- Implement a risk-based oversight program with:

- Regular performance reviews

- Security assessment requirements

- Compliance attestations

- Financial stability monitoring for critical providers

Common Challenges and Solutions

Challenge: Limited Leverage with Large Providers

Small and medium PSPs often lack negotiating power with major technology providers who may resist contract amendments or audit requirements.

Solution: Consider industry consortiums to increase collective leverage, utilize third-party assessment reports (SOC 2, PCI DSS), and document risk acceptance decisions where controls cannot be fully implemented.

Challenge: Subcontractor Visibility

Many service providers utilize their own subcontractors, creating challenges for end-to-end oversight.

Solution: Require primary vendors to maintain approved subcontractor lists, implement notification requirements for subcontractor changes, and include right-to-audit provisions that extend to subcontractors.

Timeline Considerations

- Complete third-party inventory within 3 months of registration

- Prioritize contract reviews based on risk within 6 months

- Implement full monitoring program within 12 months

- Review third-party relationships annually

Step 6: Fulfill Reporting Obligations

The Requirement

The RPAA establishes ongoing reporting requirements including annual reports, significant change notifications, and incident reporting.

Implementation Guidance

Annual Reporting

- Prepare to submit information on:

- Volume and value of payment transactions

- Operational performance metrics

- Incident statistics

- Changes to risk management framework

- Third-party relationship changes

- Compliance attestation

- Establish internal data collection processes to streamline reporting

Significant Change Notifications Develop procedures for reporting:

- New payment products or services

- Major system changes

- Corporate structure modifications

- Changes to safeguarding arrangements

- New third-party relationships of significance

Incident Reporting Create clear criteria and procedures for:

- Determining reportable incidents

- Collecting required incident information

- Meeting notification timelines (expected to be within 24-72 hours)

- Providing follow-up resolution reports

Common Challenges and Solutions

Challenge: Data Aggregation Across Systems

Many PSPs operate multiple systems that don’t easily produce consolidated reporting data.

Solution: Implement data warehousing solutions that aggregate information from disparate systems, create standardized calculation methodologies, and document assumptions used in reporting.

Challenge: Determining Reporting Materiality

Without clear guidance on what constitutes a “significant” change or incident, PSPs may over-report or miss important notifications.

Solution: Develop internal materiality guidelines based on impact to users, financial implications, and operational effects. Document your rationale and adjust as regulatory guidance evolves.

Timeline Considerations

- Develop reporting procedures within 6 months of registration

- Test data collection processes before first reporting deadlines

- Be prepared for first annual report approximately 12 months after registration

- Review reporting procedures annually

Step 7: Build a Compliance Management System

The Requirement

While not explicitly required by the RPAA, a comprehensive compliance management system is necessary to coordinate all compliance activities and demonstrate due diligence.

Implementation Guidance

Governance Structure

- Designate RPAA compliance responsibilities:

- Board-level oversight committee

- Executive accountable for compliance

- Operational compliance manager

- Departmental compliance champions

- Establish clear decision-making authority for:

- Risk acceptance

- Compliance exceptions

- Resource allocation

- Remediation priorities

Documentation Framework Create a structured approach to maintaining:

- Policies and procedures

- Risk assessments

- Testing results

- Training records

- Audit findings and remediation

- Regulatory communications

Monitoring Program

- Implement controls testing covering:

- Operational controls

- Safeguarding measures

- Incident response capabilities

- Third-party oversight

- Establish key risk indicators with thresholds for:

- System availability

- Security incidents

- Fraud rates

- Customer complaints

- Processing errors

Common Challenges and Solutions

Challenge: Building Compliance Culture

Technical teams often view compliance as a bureaucratic burden rather than a business necessity.

Solution: Integrate compliance requirements into product development methodologies, create clear compliance champions within technical teams, and develop balanced scorecards that include both innovation and compliance metrics.

Challenge: Resource Constraints

Smaller PSPs may lack dedicated compliance personnel to manage comprehensive programs.

Solution: Consider compliance technology platforms that automate documentation and monitoring, explore shared resource models with similar-sized PSPs, and prioritize controls based on risk importance.

Timeline Considerations

- Establish governance structure immediately upon registration

- Implement basic documentation within 3 months

- Develop full monitoring program within 12 months

- Conduct first comprehensive compliance assessment at 18 months

Ongoing Compliance Obligations

Achieving initial compliance is only the beginning. PSPs must maintain ongoing compliance through:

Regular Assessments

- Annual review of risk management framework

- Periodic testing of safeguarding measures

- Regular validation of operational controls

- Independent security assessments

- Third-party relationship reviews

Change Management

- Evaluate compliance impact of new products and services

- Assess technology changes against security requirements

- Review corporate changes for registration implications

- Validate third-party changes against oversight framework

Regulatory Engagement

- Monitor for Bank of Canada guidance updates

- Participate in industry consultations

- Engage with regulatory questions promptly

- Maintain open communication channels with supervisors

Industry Perspectives on Best Practices

From the Canadian Payments Association

Lynne Thibodeau, Director of Policy at the Canadian Payments Association, recommends: “PSPs should view RPAA compliance not as a checkbox exercise but as an opportunity to strengthen their operational foundations. The most successful companies will be those that integrate compliance into their business strategy rather than treating it as a separate function.”

From Leading Financial Technology Consultants

According to Michael Zhang, Principal at Deloitte’s Payments Practice: “We’re advising our PSP clients to focus on documentation and traceability. The Bank of Canada will be looking for evidence that PSPs understand their risks and have thoughtful controls in place. Being able to demonstrate your decision-making process matters as much as the decisions themselves.”

From Legal Experts

Sarah Johnston, Partner at Payments Law Partners, advises: “The registration process will set the tone for your ongoing relationship with the Bank of Canada. Be thorough, transparent, and proactive about disclosing potential issues. Regulators appreciate PSPs that demonstrate awareness of challenges and have plans to address them.”

The Business Benefits of RPAA Compliance

While compliance requires investment, forward-thinking PSPs will find significant business advantages:

Enhanced Trust

- RPAA registration signals legitimacy to potential partners

- Compliance status can become a competitive differentiator

- Demonstrated security controls build consumer confidence

Operational Improvements

- Risk management frameworks identify efficiency opportunities

- Incident response capabilities reduce downtime costs

- Third-party management strengthens vendor relationships

Strategic Positioning

- Regulatory compliance opens doors to institutional clients

- Demonstrated risk management facilitates financing

- Compliance capabilities create barriers to entry for competitors

Scaling Advantage

- Properly designed compliance programs scale with growth

- Early investment prevents costly remediation later

- Compliant infrastructure facilitates international expansion

Conclusion

The RPAA marks a turning point for Canada’s payments industry, bringing non-bank PSPs under regulatory supervision for the first time. While compliance requirements are substantial, they are ultimately designed to strengthen the payment ecosystem and build consumer confidence in digital payment services.

By following the seven steps outlined in this article, PSPs can navigate the compliance journey effectively. The key to success lies in starting early, taking a risk-based approach, documenting decisions thoroughly, and viewing compliance as an integral part of business strategy rather than a regulatory burden.

PSPs that embrace RPAA compliance will not only meet their legal obligations but also position themselves advantageously in an increasingly regulated marketplace. The investments made today in sound risk management, operational resilience, and consumer protection will yield returns through enhanced trust, stronger partnerships, and sustainable growth opportunities.

FAQ: RPAA Compliance

Q: Which PSPs are exempt from RPAA registration?

A: Exemptions include banks and other federally regulated financial institutions, provincial credit unions, closed-loop payment systems (like store gift cards), agents acting on behalf of registered PSPs, and payment systems designated under the Payment Clearing and Settlement Act.

Q: Will the Bank of Canada provide compliance tools or templates?

A: The Bank of Canada is expected to publish guidance documents but likely won’t provide specific templates. Industry associations like Payments Canada and the Canadian Lenders Association are developing compliance toolkits for members.

Q: How will RPAA compliance be enforced?

A: The Bank of Canada will have supervision authority including document requests, on-site examinations, and compliance orders. For serious violations, administrative monetary penalties of up to $10 million can be imposed.

Q: Do international PSPs serving Canadian customers need to register?

A: Yes. The RPAA applies based on whether end users are in Canada, not the location of the PSP. International providers serving Canadian customers will need to register.

Q: How will RPAA interact with provincial money services business (MSB) regulations?

A: PSPs will need to comply with both RPAA and applicable provincial MSB requirements. There is no regulatory consolidation planned, meaning separate registrations will likely remain necessary.

Q: What if my business only processes a small volume of payments?

A: The Bank of Canada may implement a tiered approach to oversight, but no minimum threshold exemption has been announced. All PSPs performing in-scope activities will need to register regardless of volume.

Q: How frequently will PSPs be examined by the Bank of Canada?

A: The Bank of Canada has indicated it will take a risk-based approach to supervision, meaning larger PSPs and those with identified issues will likely face more frequent and intensive examinations.

![RPAA Compliance Made Simple: 7 Essential Steps for Canadian PSPs [2025 Guide]](https://complyfactor.com/wp-content/uploads/2025/03/RPAA-Compliance-Made-Simple-7-Essential-Steps-for-Canadian-PSPs.png)