Canada’s financial regulatory landscape has evolved significantly with the introduction of the Retail Payment Activities Act (RPAA). Financial service providers now need to understand two distinct regulatory frameworks: Money Services Business (MSB) registration with FINTRAC and Payment Service Provider (PSP) registration with the Bank of Canada.

This guide provides a factual comparison between these two regulatory regimes based on official information from FINTRAC and the Bank of Canada as of March 2025.

| Feature | MSB Registration | PSP Registration |

|---|---|---|

| Regulatory Authority | Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) | Bank of Canada |

| Governing Legislation | Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) | Retail Payment Activities Act (RPAA) |

| Primary Purpose | Anti-money laundering and counter-terrorist financing | Operational reliability and consumer protection |

| Covered Activities | Foreign exchange dealing, money transferring, issuing/redeeming negotiable instruments, virtual currencies | Electronic payment functions including transfers of funds to third parties |

| Registration Fee | No fee for registration | Fee structure not yet published |

| Renewal | Every 2 years | Annual reporting requirements |

| Implementation Status | Fully implemented | Registration opens in 2025 |

MSB Registration Under FINTRAC

What Qualifies as an MSB?

According to FINTRAC, a Money Services Business is defined as an entity engaged in any of the following activities:

- Foreign exchange dealing: Converting one currency to another

- Money transferring: Remitting or transmitting funds by any means or through any entity or electronic funds transfer network

- Issuing or redeeming money orders, traveler’s cheques, or similar negotiable instruments

- Dealing in virtual currencies: Engaging in the business of virtual currency exchange services or virtual currency transfer services

- Operating a virtual currency ATM

An entity is considered an MSB if it offers these services to the public and is engaged in these activities as a business.

MSB Registration Requirements

To register as an MSB with FINTRAC, businesses must:

- Complete the MSB registration form through FINTRAC’s online portal, providing information about:

- Corporate structure

- Ownership

- Services offered

- Locations

- Agents or mandataries

- Financial information

- Submit to a “fit and proper” screening, which examines:

- Criminal records

- Association with money laundering or terrorist financing

- Prior compliance history

- Background of directors, officers, and owners

- Renew registration every two years by updating information and confirming continued eligibility

There is currently no fee for MSB registration with FINTRAC, either for domestic or foreign MSBs.

MSB Reporting Obligations

MSBs must submit the following reports to FINTRAC:

- Suspicious Transaction Reports (STRs): Within 30 days of detecting transactions where there are reasonable grounds to suspect money laundering or terrorist financing

- Large Cash Transaction Reports (LCTRs): Within 15 days of transactions of $10,000 or more in cash

- Electronic Funds Transfer Reports (EFTRs): Within 5 business days of sending or receiving international electronic funds transfers of $10,000 or more

- Large Virtual Currency Transaction Reports (LVCTRs): Within 5 business days of receiving virtual currency worth $10,000 or more in a single transaction

- Terrorist Property Reports: Without delay upon detecting property owned or controlled by or on behalf of a terrorist or terrorist group

MSB Compliance Requirements

Once registered, MSBs must implement and maintain:

- A compliance program including:

- Appointment of a compliance officer

- Written policies and procedures

- Risk assessment

- Ongoing training program

- Effectiveness review every two years

- Client identification procedures for:

- Transactions of $1,000 or more

- Foreign exchange transactions of $3,000 or more

- Suspicious transactions

- Creation of account relationships

- Record-keeping for a minimum of 5 years for:

- Transaction details

- Client identification information

- Account relationships

- Compliance program documentation

PSP Registration Under the Bank of Canada

What Qualifies as a PSP?

Under the Retail Payment Activities Act (RPAA), a Payment Service Provider is defined as an entity that performs retail payment activities as a service or business activity. According to the Bank of Canada, retail payment activities include:

- Payment processing: Authorization, transmission, recording, or settlement of payment instructions

- Provision of clearing or settlement services: Acting as a clearing house or settlement system

- Provision of payment accounts: Maintaining an account held in respect of an end user for the purpose of making electronic fund transfers

- Holding of funds: Controlling funds on behalf of an end user until they are withdrawn or transferred

- Payment initiation: Electronic payment functions initiated at the request of an end user

Key Exemptions from PSP Registration

The RPAA specifically exempts:

- Regulated financial institutions: Banks, credit unions, and other federally regulated financial institutions

- Closed-loop systems: Payment systems that can only be used to purchase goods or services within a limited network of businesses

- ATM withdrawals: Cash withdrawals from automated teller machines

- Internal payment systems: Systems used within a business or within affiliated businesses

- Clearing and settlement systems: Systems designated under the Payment Clearing and Settlement Act

- Agents: Entities acting as agents of registered PSPs

PSP Registration Requirements

While the registration process is not yet fully implemented, the Bank of Canada has indicated that PSPs will need to:

- Submit an application providing:

- Corporate information

- Description of payment activities

- Operational details

- Risk management framework information

- Demonstrate risk management capabilities including:

- Operational risk management

- Incident response procedures

- Business continuity planning

- Information security measures

- Establish end-user fund safeguarding if the PSP holds end-user funds, through one or more of these methods:

- Holding funds in a separate account

- Holding insurance or a guarantee

- Using a trust arrangement

- Report on third-party service providers that perform retail payment activities on behalf of the PSP

The fee structure for PSP registration has not yet been published by the Bank of Canada.

PSP Reporting Obligations

Once registered, PSPs will be required to:

- Report significant incidents that materially affect:

- Normal operations of retail payment activities

- Security or integrity of retail payment activities

- End users or other PSPs

- Submit annual reports including:

- Updated information about the PSP

- Changes to retail payment activities

- Risk management framework assessment

- Compliance with RPAA requirements

- Notify the Bank of Canada of:

- Changes in control of the PSP

- Changes in end-user fund safeguarding methods

- Cessation of retail payment activities

PSP Compliance Requirements

PSPs will need to maintain:

- An operational risk management framework that:

- Identifies and mitigates risks to their retail payment activities

- Includes incident response procedures

- Is documented and regularly reviewed

- End-user fund safeguarding if the PSP holds funds for end users, ensuring that:

- Funds are protected in case of PSP insolvency

- Record-keeping clearly identifies funds held for end users

- Safeguarding methods meet regulatory requirements

- Third-party provider management, ensuring that service providers:

- Comply with RPAA requirements

- Are subject to appropriate risk management

- Have clear contractual obligations

Key Differences Between MSB and PSP Regimes

Regulatory Focus

- MSB registration (FINTRAC): Focuses on preventing money laundering and terrorist financing

- PSP registration (Bank of Canada): Focuses on operational reliability and consumer protection in payment systems

Scope of Application

- MSB registration: Required specifically for foreign exchange, money transmission, negotiable instruments, and virtual currency activities

- PSP registration: Required for electronic payment functions regardless of the specific financial service

Compliance Requirements

- MSB compliance: Centers on customer due diligence, transaction monitoring, and suspicious activity reporting

- PSP compliance: Emphasizes operational risk management, incident handling, and fund safeguarding

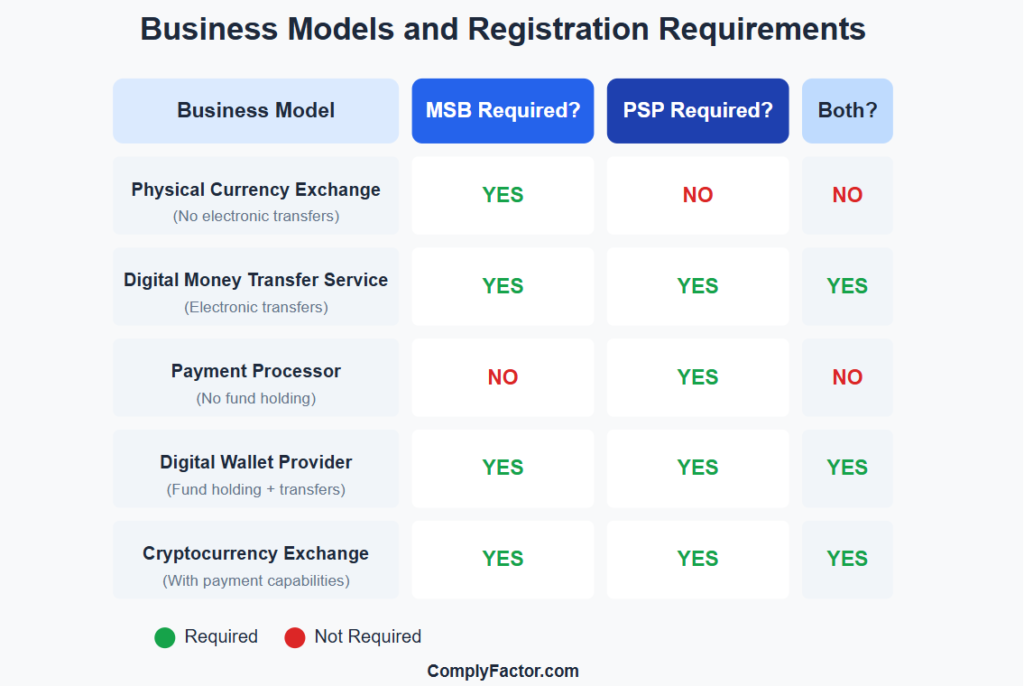

When Businesses Need Both Registrations

A business will likely need both MSB and PSP registrations if it:

- Facilitates money transfers electronically

- Holds customer funds AND provides electronic payment capabilities

- Operates a virtual currency exchange that enables transfers to third parties

Business Model Examples

Currency Exchange Business

- Physical currency exchange only: MSB registration required, PSP registration not required

- Online currency exchange with electronic transfers: Both MSB and PSP registrations required

Money Transfer Service

- Traditional money transmission service: MSB registration required

- Electronic money transfer service: Both MSB and PSP registrations likely required

Payment Processor

- Merchant payment processor (no fund holding): PSP registration likely required, MSB generally not required

- Payment facilitator holding merchant funds: PSP registration required, MSB status depends on specific activities

Digital Wallet Provider

- Digital wallet with money transfer capabilities: Both MSB and PSP registrations likely required

- Prepaid wallet for limited merchant network: May be exempt from PSP registration under closed-loop exemption, MSB status depends on services offered

Cryptocurrency Exchange

- Crypto trading platform: MSB registration required for virtual currency dealing

- Crypto exchange with payment capabilities: Both MSB and PSP registrations likely required

Decision Framework for Determining Registration Requirements

Step 1: Assess MSB Registration Requirements

Ask these questions:

- Does your business exchange currencies?

- Does your business transmit money?

- Does your business issue or redeem money orders or similar instruments?

- Does your business deal in virtual currencies?

If “yes” to any of these, MSB registration is likely required.

Step 2: Assess PSP Registration Requirements

Ask these questions:

- Does your business process electronic payments?

- Does your business provide payment accounts to end users?

- Does your business hold funds for the purpose of making electronic fund transfers?

- Does your business facilitate electronic fund transfers between parties?

If “yes” to any of these, PSP registration is likely required unless an exemption applies.

Step 3: Consider Exemptions

For PSP exemptions, consider:

- Is your business a bank or regulated financial institution?

- Is your payment system closed-loop?

- Are you acting only as an agent of a registered PSP?

Registration Process

MSB Registration Process

- Create a FINTRAC online account through the FINTRAC website

- Complete the MSB registration form providing all required information

- Receive confirmation of registration and an MSB registration number

- Renew registration every two years by updating information

PSP Registration Process

While the final process has not been fully implemented, the Bank of Canada has indicated it will include:

- Application submission through the Bank of Canada’s registration portal

- Review and assessment by the Bank of Canada

- Registration confirmation upon successful completion

- Annual reporting to maintain registration

Penalties for Non-Compliance

MSB Non-Compliance Penalties

FINTRAC can impose:

- Administrative Monetary Penalties (AMPs): Up to $100,000 for individuals and $500,000 for entities per violation, depending on the severity

- Criminal penalties: For serious violations, including fines and imprisonment

- Non-compliance notifications: Public naming of non-compliant entities

- Registration refusal or revocation: Prohibition from operating as an MSB

PSP Non-Compliance Penalties

The Bank of Canada will have authority to:

- Issue compliance orders: Directing specific remedial actions

- Impose administrative monetary penalties: For violations of the RPAA

- Apply conditions to registration: Restricting certain activities

- Revoke registration: Prohibiting continued operation as a PSP

Frequently Asked Questions

Registration Fees

Is there a fee for MSB registration?

No, FINTRAC does not currently charge a fee for MSB registration.

What is the fee for PSP registration?

The Bank of Canada has not yet published the fee structure for PSP registration.

Registration Timelines

When will PSP registration become mandatory?

How often must registrations be renewed?

MSB registrations must be renewed every two years. PSP registrations will require annual reporting.

Operational Questions

Can a business be exempt from one registration but required to obtain the other?

Yes. For example, a physical currency exchange would need MSB registration but not PSP registration. Similarly, a payment processor that doesn’t exchange currencies or transfer money might need PSP registration but not MSB registration.

How do provincial regulations interact with these federal requirements?

Some provinces have additional MSB licensing requirements (Quebec, British Columbia). PSP registration is a federal requirement under the Bank of Canada. Businesses must comply with both applicable provincial and federal requirements.

Next Steps for Businesses

- Assess your business activities against both regulatory frameworks

- Determine registration requirements based on services offered

- Develop compliance programs addressing applicable requirements

- Register with appropriate regulators according to published timelines

- Implement ongoing compliance including reporting and record-keeping

- Monitor for regulatory updates as the PSP regime is implemented

Conclusion

Understanding the distinctions between MSB and PSP registration requirements is essential for financial service providers operating in Canada. While both regimes regulate aspects of the payment ecosystem, they serve different regulatory purposes and impose distinct compliance obligations.

Businesses should take a methodical approach to determining their registration requirements, considering both current activities and future plans. By proactively addressing compliance obligations under both regimes where applicable, financial service providers can minimize regulatory risk while maintaining operational flexibility.

As the PSP registration system is implemented over the coming months, affected businesses should monitor Bank of Canada announcements for updated guidance and specific registration requirements.

Disclaimer: This guide provides general information based on regulations as of March 2025 and should not be considered legal advice. Financial service providers should consult with qualified legal counsel regarding their specific regulatory obligations.

![MSB vs PSP Licenses in Canada Complete Guide for Fintechs [2025]](https://complyfactor.com/wp-content/uploads/2025/03/MSB-vs-PSP-Licenses-in-Canada-Complete-Guide-for-Fintechs-2025.png)