Romania has emerged as the European Union’s most accessible entry point for crypto asset service providers, revolutionizing how businesses approach Romania MiCA implementation. Through Emergency Government Ordinance (OUG) 10/2025, Romania has created a streamlined regulatory framework that eliminates traditional authorization delays while maintaining robust AML compliance standards. This groundbreaking approach to crypto AML compliance Romania positions the country as the gateway for accessing 500 million EU consumers with unprecedented speed and efficiency.

Understanding MiCA Regulation in Romania

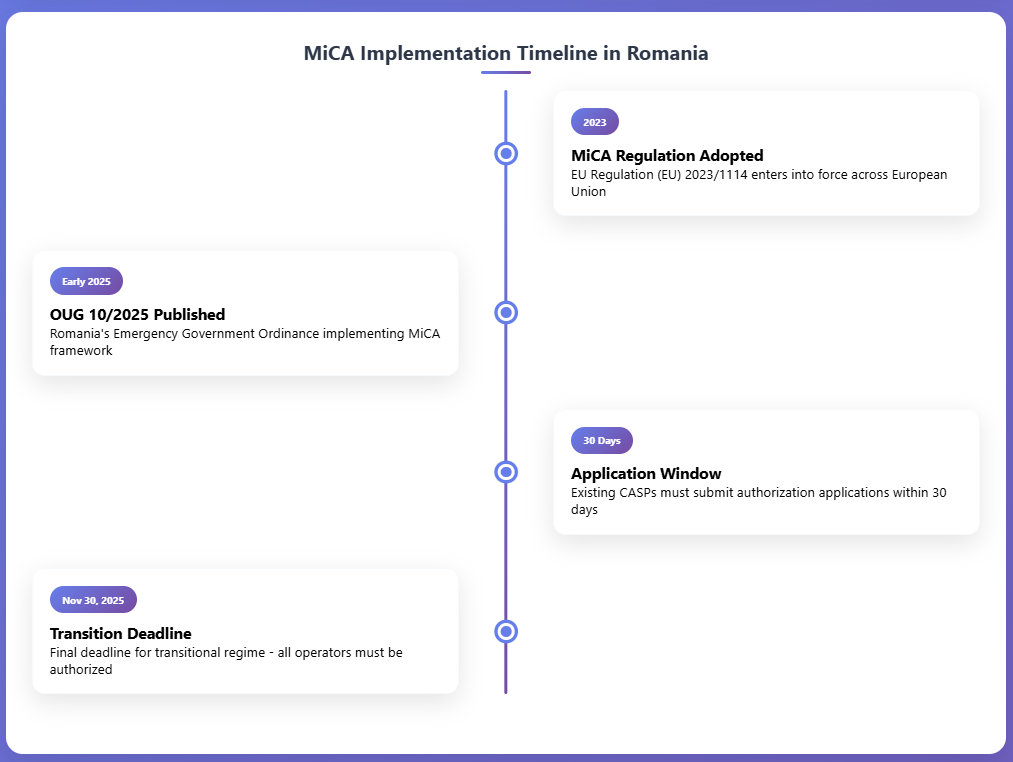

The Markets in Crypto-Assets (MiCA) Regulation represents the European Union’s most comprehensive attempt to create a unified legal framework for digital assets. Regulation (EU) 2023/1114 entered into force in 2023, but its full implementation regarding crypto asset service providers (CASPs) was deliberately postponed to allow member states adequate preparation time.

Romania’s Emergency Government Ordinance 10/2025 marks a pivotal moment in MiCA regulation 2025 implementation. Unlike other EU member states that have adopted more cautious, authorization-heavy approaches, Romania has chosen an innovative path that prioritizes market access while maintaining compliance integrity. The ordinance eliminates the need for prior authorization in many cases, removes supervisory wait times, and establishes a fast internal registration process.

This approach contrasts sharply with traditional financial services licensing, where lengthy approval processes often delay market entry by months or years. Romania’s implementation recognizes that crypto asset service providers Romania can operate effectively under a compliance-based framework rather than a permission-based system. The ordinance fully integrates crypto-asset service providers into the existing Anti-Money Laundering Law 129/2019, treating CASPs as financial institutions with comprehensive AML obligations.

The key innovation lies in Romania’s interpretation of MiCA’s flexibility provisions. While the regulation sets minimum standards, it allows member states to determine specific implementation mechanisms. Romania has chosen to emphasize operational compliance over administrative gatekeeping, creating what industry experts describe as the EU’s most business-friendly crypto regulatory environment.

Regulatory Framework & Institutional Architecture

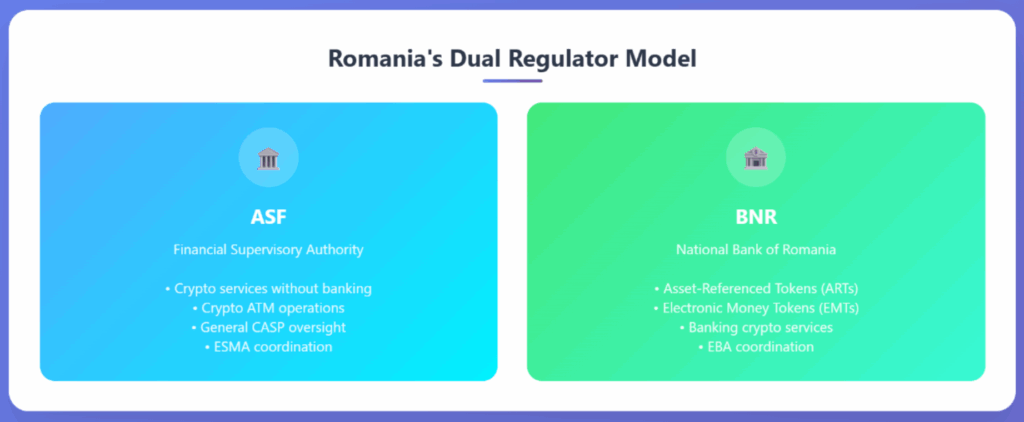

Romania’s ASF crypto licensing framework operates through a sophisticated dual-regulator model that ensures comprehensive oversight without bureaucratic redundancy. The Financial Supervisory Authority (ASF) serves as the primary regulator for crypto services without banking functions, including the operation of crypto ATMs and most CASP activities. Meanwhile, the National Bank of Romania (BNR) maintains exclusive jurisdiction over asset-referenced tokens (ARTs), electronic money tokens (EMTs), and crypto services provided by credit institutions under its supervision.

This institutional architecture extends beyond the two primary regulators. ASF acts as Romania’s single point of contact with the European Securities and Markets Authority (ESMA), while BNR maintains the corresponding relationship with the European Banking Authority (EBA). This clear delineation ensures efficient cross-border cooperation and consistent interpretation of European crypto regulations.

The supporting institutional framework includes several specialized agencies that contribute technical expertise. The National Institute for Research and Development in Informatics (ICI Bucharest) provides technical approvals for crypto ATM hardware, while the Authority for the Digitalization of Romania (ADR) oversees IT system compliance. Additional support comes from the Ministry of Internal Affairs (MAI), the National Authority for Consumer Protection (ANPC), and the National Agency for Fiscal Administration (ANAF).

Formal cooperation protocols between these institutions create a seamless regulatory environment where technical, fiscal, and security considerations are integrated into a cohesive oversight framework. This multi-institutional approach ensures that crypto AML compliance Romania standards are maintained across all operational aspects while avoiding regulatory gaps or overlapping jurisdictions.

CASP Authorization Requirements & AML Compliance

The CASP authorization Romania process represents a fundamental shift from traditional licensing models to a compliance-verification approach. Rather than requiring extensive pre-approval procedures, Romania focuses on ensuring that crypto asset service providers meet specific operational and governance standards from day one.

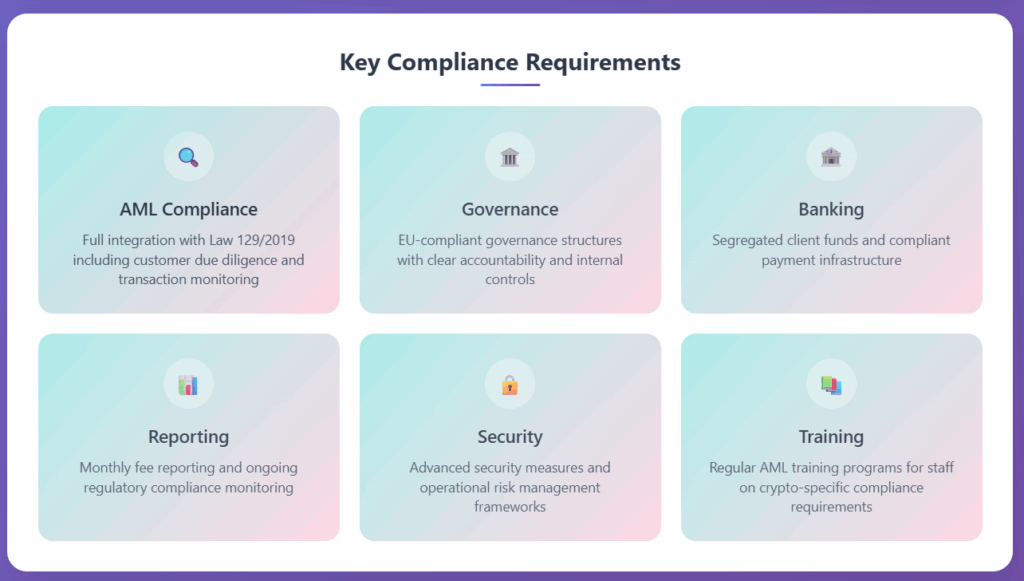

The core requirements for CASP operation in Romania include appointing a Romanian local director, implementing a comprehensive internal AML program compliant with Law 129/2019, and establishing EU-compliant governance structures. These requirements ensure that foreign entities maintain meaningful local presence while adhering to Romanian and European regulatory standards.

The financial obligations include a monthly fee equivalent to 0.5% of revenues generated from authorized activities, payable to ASF by the 15th of each following month. This fee structure supports the Authority’s regulatory and supervisory functions while creating a direct correlation between business success and regulatory contribution. Failure to maintain fee payments results in automatic authorization revocation, emphasizing the importance of ongoing compliance.

Professional services providers specializing in AML advisory services play a crucial role in helping CASPs navigate these requirements effectively. The complexity of integrating Romanian AML obligations with broader European compliance standards often requires specialized expertise to ensure comprehensive coverage without operational disruption.

The governance requirements extend beyond basic corporate structure to encompass risk management frameworks, internal controls, and ongoing monitoring systems. CASPs must demonstrate clear accountability chains, segregation of duties, and regular compliance reporting mechanisms. Many organizations find that engaging experienced global MLRO services provides the specialized knowledge needed to establish and maintain these sophisticated compliance frameworks effectively.

Crypto ATM Regulations & Technical Requirements

Romania’s approach to crypto ATM regulation demonstrates the country’s commitment to balancing innovation with consumer protection and regulatory oversight. Physical crypto terminals are defined as devices enabling users to purchase or sell crypto-assets using cash or other payment methods, and their operation requires specific ASF authorization.

The technical approval process involves two distinct certifications. ICI Bucharest must approve the physical terminal model, ensuring hardware compliance with security and operational standards. Simultaneously, ADR must approve the underlying IT system, verifying software security, data protection measures, and system reliability.

Operational requirements for crypto ATMs include implementing real-time data access mechanisms that allow regulatory authorities immediate transaction monitoring. Each terminal must incorporate user authentication systems, advanced encryption technologies, and comprehensive security measures. Location restrictions prohibit installation in publicly accessible or unsupervised premises, with operators required to provide prior notification to ASF regarding intended locations.

The terminals must comply with Government Decision No. 301/2012 regarding physical protection standards, ensuring appropriate security measures for cash-handling operations. Additionally, operators must provide complete transparency regarding fees, terms of use, and risk disclosures, ensuring users can make informed decisions about crypto-asset transactions.

AML Obligations & Compliance Challenges

The integration of crypto asset service providers into Romania’s existing AML framework under Law 129/2019 creates comprehensive obligations that extend far beyond traditional financial services requirements. The repeal of former Article 301 provisions eliminates previous ambiguities, establishing clear expectations for AML compliance crypto assets operations.

CASPs must implement robust customer due diligence procedures that account for the unique characteristics of crypto-asset transactions. This includes enhanced monitoring for unusual transaction patterns, comprehensive record-keeping requirements, and regular risk assessments that consider both traditional financial crime indicators and crypto-specific risks such as mixer services, privacy coins, and cross-chain transactions.

The ongoing compliance monitoring requirements include regular internal audits, external compliance reviews, and continuous staff training programs. Organizations often benefit from comprehensive AML audit services that provide independent verification of compliance effectiveness and identify potential improvement areas before regulatory examinations.

Risk assessment and mitigation strategies must address the evolving landscape of crypto-related financial crime, including ransomware payments, dark web marketplace transactions, and sanctions evasion schemes. The dynamic nature of these risks requires continuous adaptation of compliance programs and regular updates to detection systems.

Professional AML training programs become essential for ensuring that CASP staff understand both traditional AML concepts and crypto-specific compliance requirements. The unique characteristics of blockchain transactions, the pseudonymous nature of many crypto-assets, and the rapid evolution of DeFi protocols require specialized knowledge that goes beyond conventional financial services training.

Transitional Regime & Implementation Timeline

The transitional provisions in Romania’s MiCA implementation present both opportunities and challenges for existing crypto operators. Current CASPs may continue operations post-ordinance implementation, provided they submit authorization applications within 30 days and maintain compliance with MiCA, the ordinance, and related regulations.

However, the November 30, 2025 deadline creates significant time pressure for both operators and regulators. This ambitious timeline assumes that ASF can process and decide on all submitted applications within approximately eight months, a commitment that requires substantial administrative capacity and streamlined processing procedures.

The transitional regime’s scope remains somewhat unclear regarding providers already authorized in other EU member states under MiCA. While the ordinance appears to extend authorization requirements to all providers operating in Romania, this interpretation may conflict with MiCA’s passport provisions that allow authorized CASPs to provide services across the EU without additional local authorization.

This legal uncertainty necessitates careful compliance planning and potentially requires clarification from Romanian authorities or European supervisory bodies. Organizations navigating these complexities often require specialized legal and regulatory guidance to ensure they maintain operational continuity while meeting all applicable requirements.

Licensing Support & Banking Solutions

The complexity of establishing compliant CASP operations in Romania extends beyond regulatory compliance to encompass practical operational considerations including banking relationships, payment infrastructure, and ongoing administrative requirements. Many organizations require professional support to navigate documentation requirements, whitepaper preparation, and regulatory submission processes.

Specialized financial services license application support can significantly streamline the authorization process by ensuring complete and accurate submissions that meet ASF expectations. This support becomes particularly valuable given the tight transitional timeline and the potential for administrative bottlenecks.

Banking infrastructure presents unique challenges for crypto businesses, as traditional financial institutions often impose restrictions on crypto-related activities. Modern virtual IBAN banking services offer solutions that provide multi-currency support across GBP, EUR, AED, and USD, enabling CASPs to maintain segregated client funds and meet regulatory requirements for financial safeguarding.

The operational infrastructure must also support ongoing compliance monitoring, transaction reporting, and regulatory communication requirements. This includes establishing systems for monthly fee calculations and payments to ASF, maintaining comprehensive transaction records, and ensuring real-time data access capabilities for regulatory authorities.

Sanctions Framework & Enforcement

Romania’s enforcement approach distinguishes between administrative violations and criminal breaches, creating a proportionate sanctioning framework that encourages compliance while maintaining deterrent effects. ASF and BNR possess broad enforcement powers including administrative fines, written warnings, activity suspension, and public disclosure of sanctions.

The graduated enforcement approach allows for corrective action before severe penalties, recognizing that many compliance failures result from operational challenges rather than intentional violations. However, serious breaches such as unauthorized operations, AML violations, or consumer harm can result in immediate suspension or authorization revocation.

All sanctions are subject to procedural safeguards including the right to administrative appeal and judicial review. This balanced approach ensures that enforcement actions are proportionate, fair, and focused on achieving compliance rather than purely punitive outcomes.

The framework also provides for suspension periods of up to three years for repeated security breaches, emphasizing the critical importance of maintaining robust operational security and customer protection measures.

Strategic Recommendations

Romania’s innovative MiCA implementation creates unprecedented opportunities for crypto businesses seeking rapid EU market access while maintaining comprehensive regulatory compliance. The elimination of prior authorization requirements, combined with robust AML frameworks and clear operational standards, positions Romania as the EU’s premier crypto business destination.

Organizations considering Romanian operations should act quickly given the transitional timeline constraints and potential for administrative capacity limitations. Early preparation of compliance frameworks, governance structures, and operational infrastructure will provide competitive advantages as the market develops.

The integration of professional compliance services, from initial setup through ongoing operations, ensures that businesses can capitalize on Romania’s regulatory advantages while maintaining the highest standards of consumer protection and financial crime prevention. The combination of regulatory innovation and comprehensive compliance support creates a unique opportunity for sustainable crypto business development in the European market.

For organizations ready to establish or expand their European crypto operations, Romania’s MiCA implementation offers an unparalleled combination of speed, accessibility, and regulatory certainty that positions businesses for long-term success in the evolving digital asset landscape.

{ “@context”: “https://schema.org”, “@type”: “Article”, “headline”: “Romania MiCA Implementation: The EU’s Fastest Gateway for Crypto AML Compliance in 2025”, “description”: “Comprehensive guide to Romania’s MiCA implementation through OUG 10/2025, covering CASP authorization, AML compliance requirements, and regulatory framework for crypto businesses in the EU.”, “image”: { “@type”: “ImageObject”, “url”: “https://complyfactor.com/images/romania-mica-implementation.jpg”, “width”: 1200, “height”: 630 }, “author”: { “@type”: “Organization”, “name”: “ComplyFactor”, “url”: “https://complyfactor.com”, “logo”: { “@type”: “ImageObject”, “url”: “https://complyfactor.com/logo.png” } }, “publisher”: { “@type”: “Organization”, “name”: “ComplyFactor”, “logo”: { “@type”: “ImageObject”, “url”: “https://complyfactor.com/logo.png” } }, “datePublished”: “2025-06-15”, “dateModified”: “2025-06-15”, “mainEntityOfPage”: { “@type”: “WebPage”, “@id”: “https://complyfactor.com/romania-mica-implementation-guide” }, “articleSection”: “AML Compliance”, “keywords”: [ “Romania MiCA implementation”, “crypto AML compliance Romania”, “CASP authorization Romania”, “MiCA regulation 2025”, “crypto asset service providers Romania”, “ASF crypto licensing”, “AML compliance crypto assets”, “European crypto regulations” ], “about”: [ { “@type”: “Thing”, “name”: “MiCA Regulation”, “description”: “Markets in Crypto-Assets Regulation (EU) 2023/1114” }, { “@type”: “Thing”, “name”: “Romania crypto regulation”, “description”: “Emergency Government Ordinance (OUG) 10/2025 implementing MiCA in Romania” }, { “@type”: “Thing”, “name”: “CASP Authorization”, “description”: “Crypto Asset Service Provider licensing requirements in Romania” }, { “@type”: “Thing”, “name”: “AML Compliance”, “description”: “Anti-Money Laundering compliance for crypto businesses under Romanian Law 129/2019” } ], “mentions”: [ { “@type”: “Organization”, “name”: “Financial Supervisory Authority”, “alternateName”: “ASF”, “description”: “Romanian financial regulator responsible for crypto services oversight” }, { “@type”: “Organization”, “name”: “National Bank of Romania”, “alternateName”: “BNR”, “description”: “Romanian central bank regulating ARTs, EMTs and banking crypto services” }, { “@type”: “Organization”, “name”: “European Securities and Markets Authority”, “alternateName”: “ESMA” }, { “@type”: “Organization”, “name”: “European Banking Authority”, “alternateName”: “EBA” } ], “speakable”: { “@type”: “SpeakableSpecification”, “cssSelector”: [“h1”, “h2”, “.key-takeaway”] } } { “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is Romania’s MiCA implementation approach?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Romania implements MiCA through Emergency Government Ordinance (OUG) 10/2025, offering the EU’s fastest crypto market entry with no prior authorization required, no supervisory wait times, and fast internal registration for crypto asset service providers (CASPs).” } }, { “@type”: “Question”, “name”: “Who regulates crypto businesses in Romania?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Romania uses a dual regulator model: ASF (Financial Supervisory Authority) oversees crypto services without banking functions and crypto ATMs, while BNR (National Bank of Romania) regulates ARTs, EMTs, and crypto services provided by credit institutions.” } }, { “@type”: “Question”, “name”: “What are the main requirements for CASP authorization in Romania?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Key requirements include: Romanian local director, internal AML program compliant with Law 129/2019, EU-compliant governance structures, and monthly fee of 0.5% of revenues from authorized activities paid to ASF.” } }, { “@type”: “Question”, “name”: “What is the deadline for existing crypto operators in Romania?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Existing CASPs must apply for authorization within 30 days of OUG 10/2025 entry into force and can continue operating until November 30, 2025, provided they comply with MiCA regulations.” } }, { “@type”: “Question”, “name”: “What AML compliance requirements apply to crypto businesses in Romania?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “CASPs are treated as financial institutions under AML Law 129/2019, requiring comprehensive customer due diligence, transaction monitoring, risk assessments, regular audits, and staff training programs specific to crypto-asset risks.” } }, { “@type”: “Question”, “name”: “How are crypto ATMs regulated in Romania?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Crypto ATMs require ASF authorization, technical approvals from ICI Bucharest (hardware) and ADR (IT systems), real-time regulatory data access, user authentication systems, and installation only in supervised, secure locations compliant with Government Decision No. 301/2012.” } }, { “@type”: “Question”, “name”: “What makes Romania attractive for crypto businesses in the EU?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Romania offers the fastest EU market entry for crypto businesses with streamlined authorization processes, access to 500 million EU consumers, clear regulatory framework, and elimination of traditional licensing delays while maintaining robust compliance standards.” } }, { “@type”: “Question”, “name”: “What enforcement powers do Romanian crypto regulators have?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “ASF and BNR can impose administrative fines, written warnings, activity suspension up to 3 years, authorization revocation, and public disclosure of sanctions. All enforcement actions are subject to procedural safeguards and judicial review.” } } ] } { “@context”: “https://schema.org”, “@graph”: [ { “@type”: “BreadcrumbList”, “itemListElement”: [ { “@type”: “ListItem”, “position”: 1, “name”: “Home”, “item”: “https://complyfactor.com” }, { “@type”: “ListItem”, “position”: 2, “name”: “AML Compliance”, “item”: “https://complyfactor.com/aml-compliance” }, { “@type”: “ListItem”, “position”: 3, “name”: “Romania MiCA Implementation Guide”, “item”: “https://complyfactor.com/romania-mica-implementation-guide” } ] }, { “@type”: “HowTo”, “name”: “How to Establish CASP Operations in Romania Under MiCA”, “description”: “Step-by-step guide for setting up crypto asset service provider operations in Romania under the MiCA regulation framework”, “totalTime”: “PT30D”, “estimatedCost”: { “@type”: “MonetaryAmount”, “currency”: “EUR”, “value”: “10000” }, “step”: [ { “@type”: “HowToStep”, “position”: 1, “name”: “Appoint Romanian Local Director”, “text”: “Designate a Romanian resident as local director to meet OUG 10/2025 requirements for CASP operations”, “url”: “https://complyfactor.com/financial-services-license-application-support/” }, { “@type”: “HowToStep”, “position”: 2, “name”: “Develop AML Compliance Program”, “text”: “Implement comprehensive AML program compliant with Romanian Law 129/2019, including customer due diligence, transaction monitoring, and risk assessment procedures”, “url”: “https://complyfactor.com/aml-advisory-services/” }, { “@type”: “HowToStep”, “position”: 3, “name”: “Establish EU-Compliant Governance”, “text”: “Create governance structures meeting European regulatory standards with clear accountability chains and internal controls”, “url”: “https://complyfactor.com/global-mlro-services/” }, { “@type”: “HowToStep”, “position”: 4, “name”: “Set Up Banking Infrastructure”, “text”: “Establish segregated client accounts and payment infrastructure through compliant banking solutions supporting multiple currencies”, “url”: “https://complyfactor.com/virtual-iban-banking-gbp-eur-aed-usd/” }, { “@type”: “HowToStep”, “position”: 5, “name”: “Submit Registration to ASF”, “text”: “Complete internal registration process with Financial Supervisory Authority within 30-day transitional window” }, { “@type”: “HowToStep”, “position”: 6, “name”: “Implement Ongoing Compliance”, “text”: “Establish monthly fee payment system (0.5% of revenues), regular audit procedures, and staff training programs”, “url”: “https://complyfactor.com/aml-training-programs/” } ] }, { “@type”: “DefinedTerm”, “name”: “CASP”, “description”: “Crypto Asset Service Provider – entities providing crypto-asset services as defined under MiCA Regulation (EU) 2023/1114” }, { “@type”: “DefinedTerm”, “name”: “MiCA”, “description”: “Markets in Crypto-Assets Regulation (EU) 2023/1114 – European Union’s comprehensive regulatory framework for crypto assets” }, { “@type”: “DefinedTerm”, “name”: “OUG 10/2025”, “description”: “Emergency Government Ordinance 10/2025 – Romania’s national implementation of the MiCA Regulation” }, { “@type”: “DefinedTerm”, “name”: “ASF”, “description”: “Autoritatea de Supraveghere Financiară – Romania’s Financial Supervisory Authority responsible for crypto services oversight” } ] }